Dow Jones Industrial Average

|

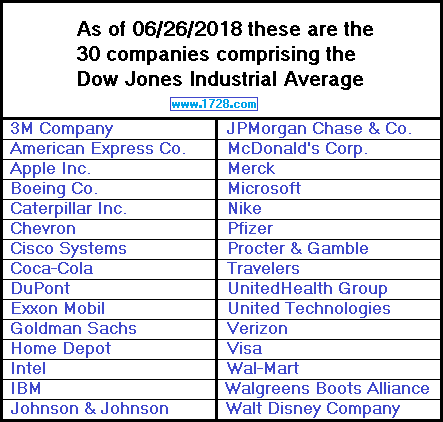

Dow Jones & Company, as well as a great many other financial publishers, literally calculate thousands of stock indexes and averages every day. However, there is no question that the most significant, most watched and most reported is the Dow Jones Industrial Average. This average, computed from the prices of 30 stocks, is sometimes referred to as the Dow Jones Average, the Dow 30 or simply the Dow. Whenever media reporters state that "the market" is down or "the market" is doing well, they are almost always talking about the Dow 30.

Dow Jones & Company was founded in 1882 at 15 Wall Street, New York and started out by delivering hand-written stock market information (called the "Customers' Afternoon Letter") to investors in the Wall Street area.

In 1884, the Dow Jones Average consisting of 9 railroads and 2 industrials first appeared in these newsletters. Eventually the "Customers' Afternoon Letter" evolved into the

Wall Street Journal first published on July 8, 1889.

On May 26, 1896 for the first time an average consisting entirely of 12 industrial stocks is published. To see the list of these 12 companies (as well as all such lists from 1896 to the present), click here. On October 4, 1916 it was calculated on the stock prices of 20 companies and finally on October 1, 1928 it was increased to 30 companies, the same number as it is today.

There are no specific criteria by which a company is chosen to be on the Dow 30. Generally, the Dow 30

is composed of very large companies that represent a variety of industries in the economy. You will never

see the Dow 30 list consisting of companies that are all in the same industry.

Any decision to add or remove any of the companies which make up the Dow 30 is made by the editors of

the Wall Street Journal.

Also, there is no particular schedule by which Dow 30 companies are changed.

On two occasions the list of Dow 30 companies went completely unchanged for over seventeen years

03/14/1939 to 07/03/1956 and 06/01/1959 to 08/09/1976.

Then again changes have been made in less than 1 month.

The Dow 20 list remained unchanged for only 3½ weeks from 12/07/1925 to 12/31/1925

and was unchanged for just 15 days from 01/22/1924 to 02/06/1924.

One of the major reasons for removing or adding companies to the Dow 30 list is to reflect major changes

in the economy. Some of the companies that were on the list such as Remington Typewriter, Victor Talking

Machine and Pacific Mail Steamship now seem very out of place. Three of the more recent additions,

Microsoft, Intel and Cisco Systems are the only NASDAQ stocks that have ever been on the Dow 30 and

they reflect the high technology aspect of the 21st century economy.

The Dow Jones Industrial Average is not the only Dow Jones average. There is also the Dow Jones Railroad Average, first published in October 26, 1896. This average was always calculated from the stock prices of 20 railroad companies until 1968. Over 70 years, the economy had changed so much that railroads were no longer the major mode of transportation and so the list now consisted of 20 transportation companies. In 1970, the name was changed to the Dow Jones Transportation Average, by which it is still known today.

On January 2, 1929, the Dow Jones Utilities Average, calculated from 18 utilities, appeared for the first time. Six months later it was calculated from twenty utilities. In June 1938, it was based on 15 utilities and this number has remained to this day.

How the Average Is Calculated

In 1896, the Dow Jones Industrial Average was easily calculated by adding the price of each company's stock and then dividing by 12. This simple procedure became more complicated whenever a company underwent a stock split.

|

|

A company decides to make a stock split whenever its stock price becomes a little too expensive. For example, a company whose stock price has increased to $1,000 may feel that investors would be reluctant to buy such expensive shares. The company might decide to make a 4 for 1 stock split which means that every share everyone owns now becomes 4 shares but each is now worth $250. So, shareholders have not become 4 times richer, the company's worth has not quadrupled and the only change is that the stock price is at a more attractive $250.

|

| |

|

These stock splits had to be taken into account ever since 1896 and by 1927 the average was computed by multiplying American Can's stock price by 6, General Electric by 4, Sears by 4, American Car and Foundry by 2 and American Tobacco by 2 and then dividing by the number of stocks on the index. As can be seen, this calculation was getting increasingly complicated and so on October 1, 1928 the Dow divisor made its first appearance. Its value at that time was 16.67 and so the stock prices of the Dow 30 would be added up and then divided by 16.67.

Let's use an example to show the way in which the divisor works.

To make things simple, we'll only use 3 fictitious companies (with their closing prices):

Arizona Aircraft 1,200

Boston Bismuth 227

Carolina Cable 73

So for these 3 companies, the fictitious Dow 3 Average would simply be the total divided by 3

Average = 1,500 ÷ 3 = 500 Now at the close of the business day, Arizona Aircraft decides to make a 4 for 1 stock split and so its stock price is now $300. If we add up the stock prices we get 600 and dividing by 3 we only get 200. However, the Dow average must be consistent and can only change values based upon actual changes in stock price and not stock splits. In other words, the Dow 30 can't close with one value and then open on the next day with a drastically different value.

So, to calculate a new divisor, we use the formula:

So, the new divisor = 3 × (600 ÷ 1500) = 3 × .4 = 1.2

So, the new divisor = 3 × (600 ÷ 1500) = 3 × .4 = 1.2

Calculating the "new" average we get a total of 600 and dividing it by 1.2 equals 500 which is exactly the same as the "old" average, thus leaving the Dow 30 average unchanged. One of the strange results about using the Dow divisor is that now the "average" stock price of the 3 companies is larger than any one of those three stocks (but we know that the "real" price of Arizona Aircraft is $1,200, right?)

From this point on, we would continue to use the new divisor of 1.2 until another stock split occurred or if any companies are added to or removed from the Dow 30 list.

So, for example, several months after that stock split calculation, our fictitious Dow 3 closes at the following prices:

Arizona Aircraft 316

Boston Bismuth 215

Carolina Cable 75

and the 'Dow 3' average is 505 (you did remember to divide by 1.2 and not 3 right?)

Now let's suppose the editors at the Wall Street Journal decide that Delaware Drilling (which closed at $13 per share) will replace Boston Bismuth.

So, the opening prices of the 'Dow 3' will be:

Arizona Aircraft 316

Delaware Drilling 13

Carolina Cable 75

We now need a different divisor value.

New sum is 316 + 13 + 75 = 404

Old sum is 316 + 215 + 75 = 606.

New divisor = 1.2 × (404 ÷ 606) = .8

Is this correct? The new sum of our fictitious Dow 3 is 404 and dividing that by .8 equals 505 which exactly equals the previous night's closing figure.

Calculating The New Dow Divisor for June 8, 2009

First, let's calculate the closing Dow Jones Industrial Average for 06-05-2009.

The closing stock prices of the companies that comprise the Dow 30 were:

| Company Name | |

Company Name | |

Company Name | |

3M Co. | 60.94 | Alcoa Inc. | 10.94 | American Express | 24.95 |

AT&T Inc | 24.56 | Bank of America | 11.86 | Boeing | 52.65 |

Caterpillar | 38.47 | Chevron | 69.37 | Citigroup | 3.46 |

Coca-Cola Co. | 49.44 | DuPont | 27.00 | Exxon Mobil | 72.97 |

General Electric | 13.54 | General Motors | 0.865 | Hewlett-Packard | 37.35 |

Home Depot Inc. | 24.17 | Intel | 15.92 | IBM | 107.24 |

Johnson & Johnson | 55.93 | JP Morgan | 34.55 | Kraft Foods | 26.67 |

McDonald's Corp. | 59.87 | Merck & Co Inc | 26.07 | Microsoft Corp. | 22.14 |

Pfizer Inc. | 14.51 | Procter & Gamble | 53.18 | United Technologies | 56.39 |

Verizon | 29.25 | Wal-Mart Stores | 51.07 | Walt Disney Co. | 24.95 |

Adding up these 30 amounts, we get 1,100.235 and when divided by the current divisor 0.125552709 equals

8,763.13 which is the closing price of the Dow Jones Industrial Average for June 5, 2009.

On Monday June 08, 2009 when the New York Stock Exchange opens, two of these stocks

(General Motors and Citigroup) will be replaced in the Dow 30 by two others

(Cisco Systems and The Travelers Companies), thus requiring a change in the Dow Divisor.

To calculate the new divisor, we first must calculate a "new sum" by using the "old sum", subtracting

the stock price of the companies being replaced and adding the stock prices of the two companies

being included.

| Old Sum | 1,100.235 |

Citigroup | -3.460 |

General Motors | -.865 |

Cisco Systems | 19.870 |

Travelers | 43.750 |

New Sum | 1,159.530 |

new divisor = previous divisor × New Sum ÷ Old Sum

new divisor = 0.125552709 × 1,159.530 ÷ 1,100.235

new divisor = 0.132319125

For a double check, the new sum 1,159.530 divided by the new divisor equals 8,763.13 which is precisely

the Dow 30 June 5, 2009 closing average and the June 8, 2009 opening average. Even though two

stocks have been removed and replaced by two others, the Dow Jones closing and opening averages remain

the same. (Only the divisor has changed).

As of September 28, 2018 the Dow Divisor is 0.14748071991788

To see the current Dow Divisor value, please click

here.

Actual Calculation of the Dow 30 Average for 03-07-2008

On 03-07-2008, the closing prices for the stocks that make up the Dow 30 were:

| Company Name | |

Company Name | |

Company Name | |

3M Co. | 76.51 |

Alcoa Inc. | 36.60 |

American Express | 41.53 |

American International | 42.88 |

AT&T | 35.01 |

Bank of America | 36.74 |

Boeing | 76.60 |

Caterpillar | 69.84 |

Chevron | 85.26 |

Citigroup | 20.91 |

Coca-Cola | 58.85 |

DuPont | 45.00 |

Exxon Mobil | 82.49 |

General Electric | 32.23 |

General Motors | 21.96 |

Hewlett-Packard | 47.31 |

Home Depot | 25.88 |

Intel | 20.07 |

IBM | 113.94 |

Johnson & Johnson | 61.51 |

JPMorgan & Chase | 37.56 |

McDonald's | 52.27 |

Merck | 41.75 |

Microsoft | 27.87 |

Pfizer | 21.35 |

Procter & Gamble | 65.80 |

United Technologies | 67.49 |

Verizon | 35.08 |

Wal-Mart | 49.90 |

Walt Disney | 30.76 |

If we add up all 30 amounts, we get 1,460.95. Now we must divide this total by the Dow Jones Industrial Divisor, whose value on March 7, 2008 was

0.122834016 and so 1,460.95 ÷ 0.122834016 equals 11,893.69 which was the precise closing value of the Dow Jones Industrial Average for 03-07-2008.

Return To Home Page

Copyright © 1999 -

1728 Software Systems

|